Staffing

LSQ helps staffing companies with payroll funding needs.

Need more money with a larger credit facility? Need funding on un-billed invoices (where you can only invoice at EOM)? Unable to utilize your full availability?

LSQ has years of experience in delivering needed liquidity for temporary staffing firms.

Funding Provided

$30 Billion

Invoice Credit Lines Up To

$100 Million

Years in Business

25 Years+

Existing Customers Funded

Within 24 Hours

What is Accounts Receivable Finance (Factoring) for Staffing?

A Flexible Source of Capital for Staffing Firms

Invoice finance (factoring) is an easy way to manage your cash flow and scale your business. LSQ offers competitive rates, the largest credit facilities, and flexible deal structures to meet your liquidity needs.

Factoring is a great option to supplement or use in lieu of a traditional line of credit. Invoice finance is accessible to staffing firms of all sizes, regardless of time in business or credit history and is a great option to to inject needed liquidity for growing businesses.

Get Paid Faster

Get same day funding by freeing up cash trapped in unpaid invoices.

Improve Financials

Improve cash flow, credit and working capital, all without adding debt.

Scale Smarter

Access credit lines up to $100M to scale with your business’s growth.

How It Works

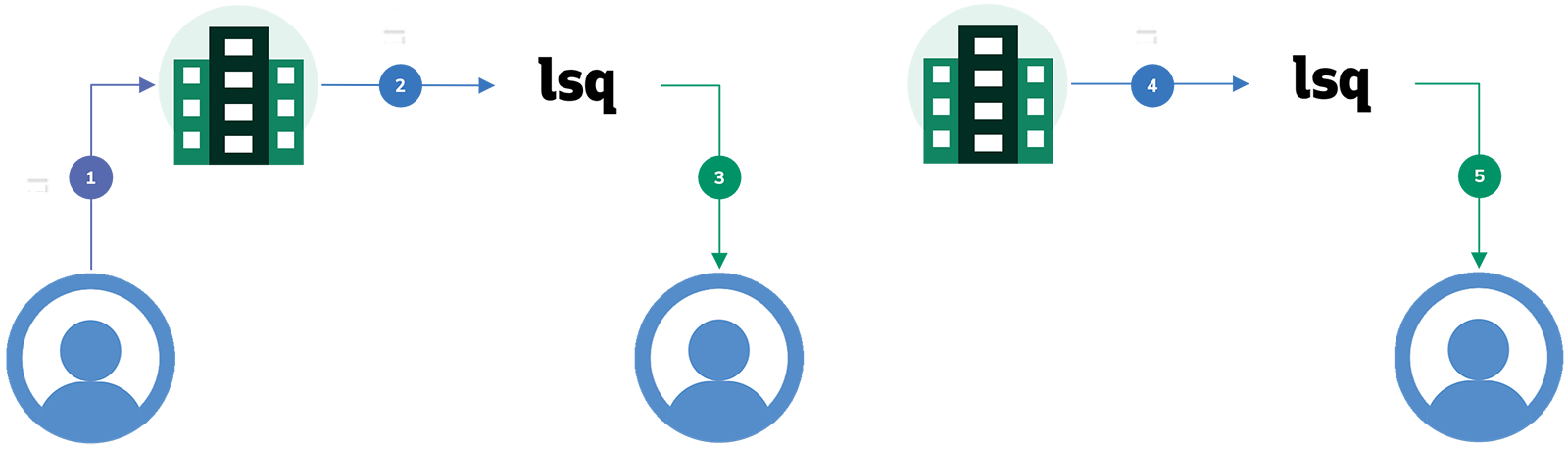

Understanding Accounts Receivable Finance

Invoice finance, or factoring, lets staffing firms get paid faster and lets them use the funds they’ve already earned to run and grow their business – even in the face of onerous payment terms. LSQ will pay up to 90% of your invoice within 24 hours, and the remaining amount is paid on the original due date.

Step 1

Bill your customer as usual

Step 2

LSQ purchases your invoice or receivable

Step 3

LSQ pays you up to 90% of the invoice within 24 hours

Step 4

At the original Net terms due date, your customer pays LSQ for the invoice

Step 5

LSQ pays you the reserve, less our fee

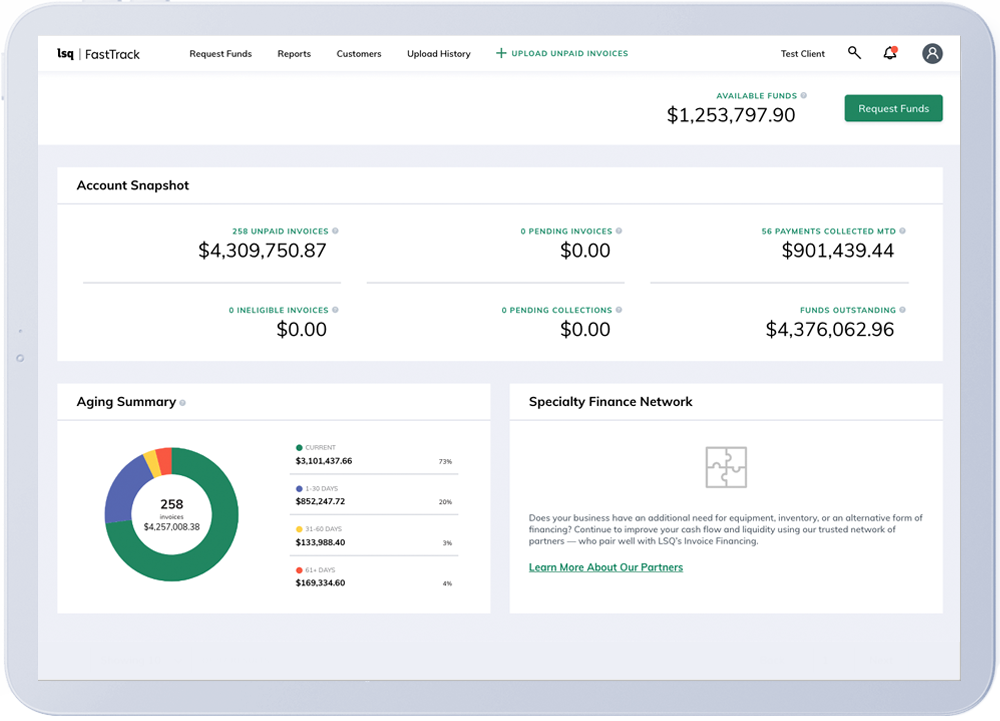

AR Management Platform

Upload Your Invoices, Download Your Money

Access to funds within 24 hours

Digitizes and reviews invoices for errors

Easy invoice uploads in a variety of formats or in-bulk

Comprehensive, real-time reports and dashboards

Access credit insights of customers and prospects

Customizable notifications and alerts

Contact Us

Related Content