Benefits of Payments Management

Streamline Supplier Payments

Use LSQ FastTrack® to pay all your suppliers, early or at net terms. By choosing FastTrack as your supplier payment solution, you can exponentially improve the adoption and utilization of your accounts payable finance program, reduce costs, and automate all payments.

Improve Efficiency

Streamline the AP process by consolidating and automating all supplier payments.

Reduce Costs

Eliminate check costs, avoid late payment fees and reduce operational overhead.

Enhance SCF Adoption

Maximize participation of early payment solutions by your supplier base.

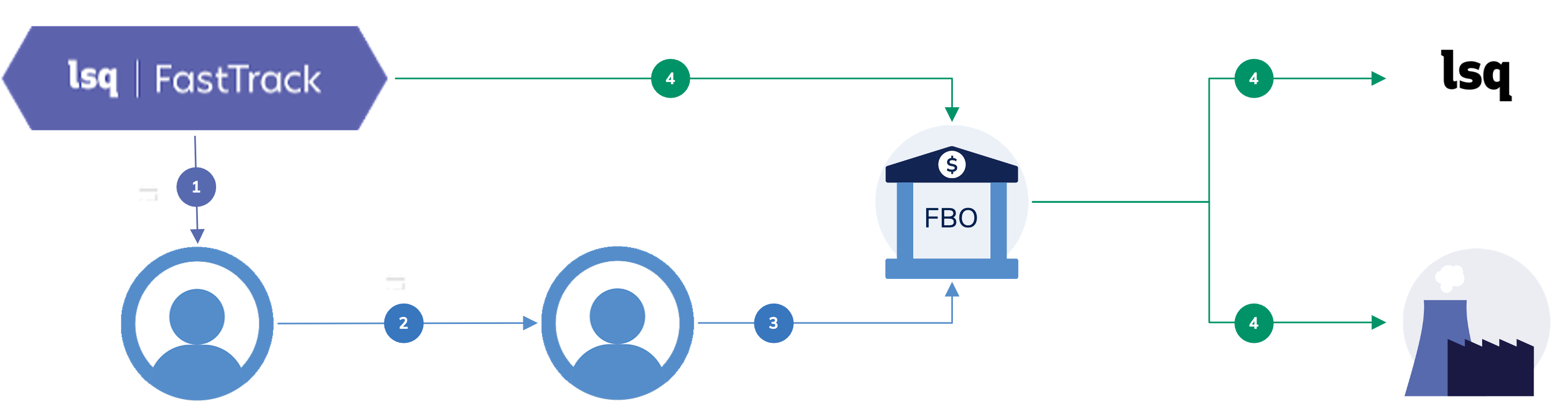

How Payments Management Works

Outsource Accounts Payable Management

Outsourcing your accounts payable process has never been simpler. By utilizing an FBO (for benefit of) account to pay suppliers you control the flow of funds into the account while LSQ routes payments to suppliers.

Step 1

FastTrack sends payment reconciliation information to buyer

Step 2

Buyer confirms invoices and payment amounts

Step 3

Buyer deposits money for all invoices into For-Benefit-Of (FBO) account

Step 4

LSQ verifies funds in FBO account and disburses payments: LSQ is paid for early payments it made to suppliers; Suppliers paid at maturation of NET terms

SUPPLIER PAYMENTs

Let suppliers choose when and how to get paid

Total Payment Management (TPM) offers suppliers new options for how they get paid. Our solution helps digitize all payments and removes checks as a default payment method.

In tandem with supply chain finance or dynamic discounting, TPM gives suppliers the ability to manage and improve their cash flow through accelerated, automated, or scheduled payments.

Suppliers paid via ACH, Wire or RTP

Suppliers can be paid on demand, at set terms, or at maturity

Implementation

Accelerate time-to-value

With LSQ, there is no clunky implementation to kick off your payments solution. We offer no-code, SFTP, and API data-integrations options that work with your existing software estate and require little or no IT resources to launch.

No-code, SFTP, and API implementations

Launch in a matter of days, not months

Case Studies

![LSQ-merger_Logo_Stacked_white[84]](https://www.lsq.com/wp-content/uploads/2025/02/LSQ-merger_Logo_Stacked_white84-200x97.png)