Author

Andy Cagle

Share

When looking for invoice financing solutions, it’s not uncommon to find providers who lack expertise, provide inadequate support, or offer a sub-standard online experience. Our current client, New World Stainless, came to LSQ from a provider who fits this description. We want to share their experience, and how LSQ changed their perception of factoring from a source of frustration to an integral part of their organization.

Challenge

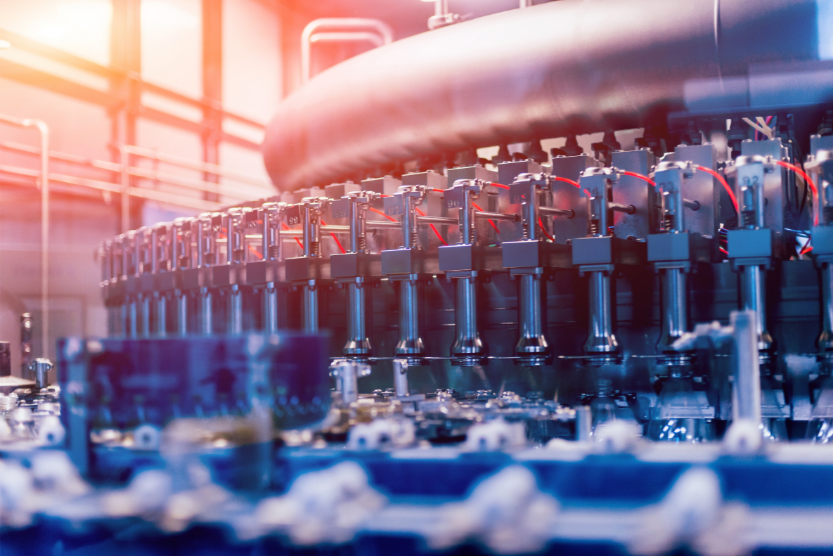

Since opening its doors in 2009, New World Stainless has experienced consistent growth manufacturing welded stainless steel tubing for the oil and gas industry. When a recession hit the industry in 2015, CEO and Founder Joe Zielinskie approached a local bank to obtain an SBA loan and a factoring line of credit to address the company’s mounting cash flow issues.

Working with the bank quickly turned into a “nightmare”. The bank lacked an online portal, had limited hours, and offered little customer support. It became clear that they didn’t have appropriate resources dedicated to managing receivables, and as a result, Joe found himself on the phone for 3 hours every day working with his bank.

“They were insistent on seeing so much of our information on a regular basis, and I don’t mean just monthly reporting, they were into what we were doing on a daily basis, it was driving me nuts. I was so frustrated.”

The final straw was when Joe requested a funds transfer to pay off an upcoming loan payment. A few days later, the funds had still not been transferred, and his account became overdrawn. When Joe confronted the banker about what had happened, the banker responded, “I forgot.”

“That’s when I decided we needed to go in a different direction, and I got introduced to LSQ.”

Solution

In 2016, New World Stainless started working with LSQ to finance their receivables. They received an 85% advance rate on all invoices and were provided crucial over-advances to meet all of their cash flow needs.

“LSQ has served to be my safety net in terms of day-to-day operation. If I need something, I know your folks are there. Our cash flow is not always level. There are peaks and valleys, and we make use of LSQ when we hit the valleys.”

Joe was also struck by the improvement of how much time he saved through the LSQ Dashboard and account management team. “Now it only takes 15 minutes. I pull up LSQ to check my availability, check collections, and to make funding requests. The time that I spend working with LSQ is always productive.”

The responsiveness and professionalism of the LSQ team further impressed Joe. It’s not uncommon for him to get on the phone with his LSQ account managers to discuss his customers’ financial health or how to approach certain financial situations. “They’re always helpful. They know the customers, and they know the issues. If I ever have an issue, they understand.”

Joe has peace of mind knowing that his receivables and collections are being handled by LSQ. The relationship has been so smooth that he now considers LSQ an extension of his own business.

“You folks have been so helpful and valuable to what we’re doing here that I have grown to consider LSQ as a segment of our organization.”

Stay in the loop