Author

Andy Cagle

Share

When macroeconomic winds change and uncertainty begins to creep into a business’s operations and financial outlook, companies take a closer look at their liquidity and start scrambling for ways to make the most of their cash and optimize working capital. It’s the first reaction to any potential downturn in revenue or rising cost. The problem is many companies don’t understand the levers they can pull to help prepare for – or weather – turbulent economic conditions.

“If you are a treasurer, you have to ask questions like, ‘what do we need to handle the normal volatility?’ ‘What if things go worse?’,” Strategic Treasurer founder Craig Jeffery said. “To be the steward of your organization’s treasury, you have to take all the steps necessary to ensure adequate liquidity and safety for your business in less than ideal economic times.”

To better understand the topic, Jeffery sat down with our Vikas Shah to discuss the various levers available to treasury departments to help them improve working capital without sacrificing the health of their supply chain.

“Every time there’s economic uncertainty, a certain percentage of customers or partners adjust the dial a bit and they’ll pay a little bit slower,” said Jeffery. “This creates a little bit of financing on the part of the seller. To make the whole buyer/supplier dynamic work, you have to eliminate the binary someone’s-paying-later/someone’s-getting-paid-later-option and replace it with additional flexibility.”

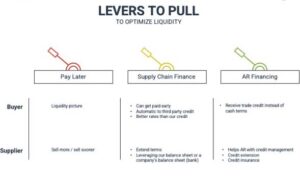

According to Jeffery, having a diverse set of levers in place before economic conditions worsen is key. In their discussion, Shah identified some of the levers that give companies those options, including:

“Having access to these levers to ensure working capital optimization is no longer a luxury,” said Shah. “They are ‘must haves’ to be successful for enterprises.”

But Shah warns, not all capital is equal; it is important for treasurers and CFOs to take a deeper look at options before committing to a working capital solution.

“A lot of companies get stuck around this concept of ‘how cheap is my capital?’,” he said. “‘Am I getting the right interest rate?’ But they don’t think about optionality and flexibility. Unfortunately, many working capital solutions are laden with usage thresholds and restrictive covenants and just don’t meet liquidity needs as headwinds change or strengthen.”

Rising Interest Rates and Supply Chain Finance

Within the context of rising interest rates – an obvious concern for many of the session’s attendees – Shah and Jeffery discussed the impact on the ability of small-to-medium businesses to acquire financing and what impact that could have on an enterprise’s supply chain.

“Even in normal circumstances, there is less credit available to the various suppliers, generally,” said Jeffery. “Even if they have good credit ratings, there’s less money chasing them due to their size. As interest rates rise, their cost of funds becomes higher, obviously, but you also see even less cash available to them, even at a higher price.”

According to Shah, this is when supply chain finance becomes an even more important lever.

“Supply chain finance drives payment speed, transparency and certainty,” he said. “When companies are struggling with the supply chain challenges we have seen, they don’t want to find themselves in a situation where slow payments impact strategic and critical suppliers. Supply chain finance, using third-party funding, meets the goal of maintaining a healthy supply chain, while maintaining liquidity for the buyer.”

Jeffery and Shah’s session, Liquidity Management: Multiple Cross-Currents, Multiple Levers, is available on demand. Their conversation dives deeper into the topics discussed above and many more. If you made it this far in this piece, you will find the recording useful and thought provoking.

Stay in the loop

![LSQ-merger_Logo_Stacked_white[84]](https://www.lsq.com/wp-content/uploads/2025/02/LSQ-merger_Logo_Stacked_white84-200x97.png)