Author

Andy Cagle

Share

Cash is KING!

This was the mantra of companies at the start of the pandemic. According to McKinsey, “Improved cash flow brings financial flexibility, which in turn increases companies’ resilience during downturns.” Companies heeded the advice and took to securing their businesses by focusing on maximizing cash.

Unfortunately, increased issues and errors in the source-to-settlement process resulted in significant cash flow disruptions.

The closing of borders, the shortages of key supplies, delays in shipments and logistics, and, for many people, working remotely without the ability to quickly collaborate with colleagues created a working environment unlike anyone had ever expected or experienced. So now instead of being responsive to the needs of the business, companies are being reactive to the market conditions.

Upstream activities, like sourcing and procurement are searching out alternative sources for materials and service providers, oftentimes “short-cutting” established processes to assure business continuity. Unfortunately, these shortcuts tend to reveal themselves downstream when it comes time to pay suppliers. Invoice approval times have increased substantially, effectively eliminating many opportunities for working capital optimization. Additionally, account payable personnel are dealing with increased supplier payment inquiries.

The result: additional pressure on businesses and accounts payable teams during the Great Resignation.

So what’s really going on?

The pandemic amplified the usual 20 percent of issues in the source-to-settlement process and flipped the Pareto Principle for many organizations. Prior to the pandemic, through AP automation, companies had fewer exceptions, but now exceptions are increasing.

In their 2021 annual survey of procurement and accounts payable professionals, Ardent Partners, a research and advisory firm focused in the supply chain and source-to-settlement processes, found that, among respondents:

- 60 percent say invoice/payment approvals take too long

- 48 percent report high percentage of exceptions

- Staff is spending 22 percent of their time handling supplier exceptions and inquiries

The same survey respondents cited their largest payment challenges as:

- Processing manual checks (cost and time)

- Managing vendor payment/banking details

- Gaining timely approval of invoice and payments

More specifically, the data shows business conditions have caused costs and inefficiencies to rise substantially within businesses.

- Average cost of processing a single invoice increased by 8 percent during 2020 to $10.89. The first increase in cost in more than 13 years of this survey.

- Time to process a single invoice (receipt to “ready-to-pay”) is now 10 days, up from 8.3 days in early 2020.

- 24.6 percent of invoices were flagged for exception handling by AP staff, an almost quarter of all invoices.

- Increased use of “gig” workers during the pandemic increased AP workload with 43.5 percent of “non-employee” labor being paid through AP and not HR payroll.

These inefficiencies adversely impact companies’ ability to optimize working capital. Payments is a key process in an optimized working capital program, regardless of company size.

So how do we optimize our working capital during these tumultuous times?

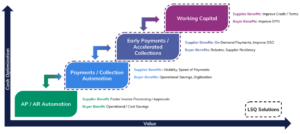

At LSQ, we like to consider the working capital maturity framework. This framework helps companies understand the relationship between AP and working capital while detailing a path to increase value and working capital optimization.

The maturity framework consists of four distinct functional areas:

- AP/AR Automation

- Payments/Collection Automation

- Early Payments/Accelerated Collections

- Working Capital

As every company has to make payments and do collections, a company can enter this maturity model at any point and move up and/or down. Many companies may do some aspect of each process, but the important thing is to make sure that you continue to focus on each aspect of the maturity framework at all times.

In our next blog in this series, we will dive deeper into each of these areas and how businesses can balance these activities to maintain optimal cash.

Remember: “Cash is KING!”

Stay in the loop

![LSQ-merger_Logo_Stacked_white[84]](https://www.lsq.com/wp-content/uploads/2025/02/LSQ-merger_Logo_Stacked_white84-200x97.png)